Shopping Cart

0 item(s) - FreeCustomization and Conversion for: MetaTrader(MT4, MT5), Thinkorswim, NinjaTrader, MultiCharts, Tradingview, Prorealtime, SierraChart, etc.

License renew price will be 20% off for the 2nd year and after.

Volume profile range indicator for MT4

This is a Permanent access license.

The price is for one MT4 Account Number activation.

Volume profile (VP) is one of the most important and useful indicators in technical analysis. It displays three basic variables (price, volume and time) in one chart, which made it more straightforward to read for both professionals and beginners. Users can easily spot volume at a specific price level in a given timeframe.

This MT4 indicator is able to show the tick volume profile in a given range with many advanced features. Some key supply and demand (supply or demand) levels at a specific price range become more obvious by using this indicator.

How it works?

The Volume profile is plotted as a horizontal histogram on a chart at the same level of the price traded.Each VP bar represents the total tick volume for the price at the same horizontal level.

Both UP/positive and DOWN/negative volume starts from the same point, it's either the right side or the left side of the chart window depends on your input choice.

Note that this VP indicator will not show the Volume Profile of every trading session.

Click an image to view at full size.

Features and Inputs:

- It works on all timeframes.

- Tag, if you apply two instances of this indicator on the same chart, makes sure you use a different tag for each of them.

- Bar Range: Adjust a particular number of bars on the chart to show the total amount of tick volume profile. If you set 50, the indicator will display the tick volume profile for the latest 50 bars. Users can increase or decrease this number to suit their preferences.

- Profile width, the maximum width of the VP allowed on the chart.

- Profile style, there are two of them which are Rectangle and line.

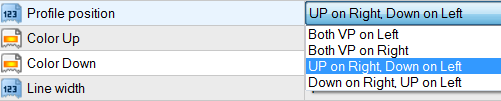

- Profile position, there are 4 options for you to choose.

- Color Up, the color for UP/positive VP bar.

- Color Down, the color for down/negative VP bar.

Note that volume is down/negative when the close price moves down, Volume is up/positive when the close price moves up. - Line width, this only apply to Line style, if you chose Rectangle there will be no effect.

- Show POC (Max Vol level Line), enable/disable the line for the Max VP level.

The color of the POC line is the same as the corresponding VP bar. - Max level line width and style inputs control the property of POC line.

- VP Start line highlights where the VP bars begin, if Bar Range=100 a vertical line will be drawn at 100 bars ago from the latest(current) bar on the chart. If there is a new bar generated on the chart the VP Start line will be redrawn at one bar on its right side.

VP Start line color and style inputs control the property of VP Start line.

If you chose to display both VP on the same side with Rectangle style, their color will overlap.

In the chart below, Down/negative volume is set to red color and UP/positive volume is green color. When there is more Down/negative volume than UP/positive volume at the same level, the positive volume color will be shown as a yellow bar, and vice versa.

Click an image to view at full size. It shows the total amount of volume for a particular number of bars on the chart.

The chart above is set to position "Both VP on Left" and the chart below is set to position "Both VP on Right". You can choose a preferred position to get a better view.

The vertical yellow dash line(VP Start line) is where the VP starts from, it means that the VP calculation is based on those bars on the right side of the VP Start line.

The chart below is set to position "UP on Right, Down on Left", it makes possible if you want to view UP/positive and DOWN/negative VP separately.

If you want to check the Volume profile for both short and long range, you can use one indicator with a small range input and another one with a large range. The chart below has two VP indicators, the left side one has a larger value of Volume profile input, it starts from the cyan line. The right side one has a smaller value of Volume profile input, it starts from the yellow line.

The chart below also has two VP indicators on the chart with the same inputs as the chart above, the only difference is their timeframes. The chart above is on a 1-hour chart the chart below is on 15 minutes.

The POC (Max VP level Line) is very useful in detecting and estimating current and future support and resistance levels.

It is important to confirm VP with other indicators and analysis techniques, chart patterns and divergence are good complements to it.

The following videos show how it works in real-time. You will get better ideas of how the indicator react to different inputs.

Write a review

Your Name:Your Review: Note: HTML is not translated!

Rating: Bad Good

Enter the code in the box below:

Custom Alert, Autotrader, Indicators, Scan, Screener, Strategy and Signals.

Copyright @ 2023 Patternsmart - All rights reserved

This website is for educational and informational

purposes only and should not be considered a solicitation to buy or sell a

futures contract or make any other type of investment decision. It's not recommended to use any single indicator as sole evaluation criteria. The companies

and services listed on this website are not to be considered a recommendation

and it is the reader's responsibility to evaluate any product, service, or

company. patternsmart is not responsible for the accuracy or content of any

product, service or company linked to on this website.

Futures trading

contains substantial risk and is not for every investor.Please read the following risk disclosure before considering the

trading of this product:

Futures Risk Disclosure. An investor could

potentially lose all or more than the initial investment. Risk capital is money

that can be lost without jeopardizing ones financial security or life style.

Only risk capital should be used for trading and only those with sufficient risk

capital should consider trading. Past performance is not necessarily indicative

of future results.

Trading stocks, options, futures and forex involves

speculation, and the risk of loss can be substantial.Investor must consider all

relevant risk factors, including their own personal financial situation, before

trading. Trading foreign exchange on margin carries a high level of risk, as

well as its own unique risk factors. Forex investments are subject to

counter-party risk, as there is no central clearing organization for these

transactions. Please read the following risk disclosure before considering the

trading of this product:

Forex Risk Disclosure. Spreads, Straddles, and other multiple-leg option

strategies can entail substantial transaction costs, including multiple

commissions, which may impact any potential return. Options are not suitable for

all investors as the special risks inherent to options trading may expose

investors to potentially rapid and substantial losses. Prior to trading options,

you should carefully read

Characteristics and Risks of Standardized Options.

patternsmart.com

will not be held liable for the loss of money or any damage caused from relying

on the information on this site. Any investment decision you make in your account is solely your responsibility.

TESTIMONIAL DISCLOSURE: TESTIMONIALS APPEARING ON OUR SITE MAY NOT BE REPRESENTATIVE OF THE EXPERIENCE OF OTHER CLIENTS OR CUSTOMERS AND IS NOT A GUARANTEE OF FUTURE PERFORMANCE OR SUCCESS.

(

(

-80x80.png)